Quick Ways to Raise Your Credit Score

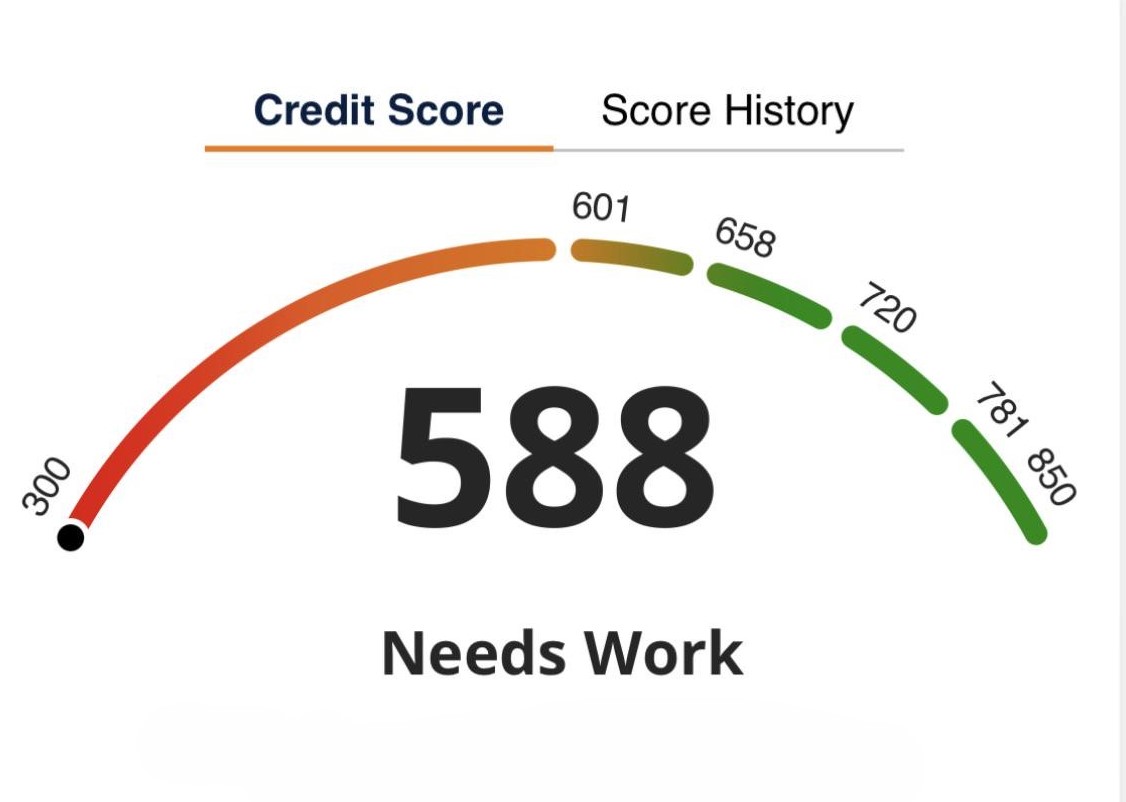

A good credit score makes it easier to get a loan, get a greater credit limit, and get a home or other financing. The good news is that you can fast improve your score by doing things. If you keep working hard, you usually see benefits in a few weeks or months. Look below for quick ways to raise your credit score.

1. Look at your credit reports

First, errors on your credit report, such as wrong late payments or accounts you don’t know about, might hurt your score. So, go to AnnualCreditReport.com to get free reports from Equifax, Experian, and TransUnion. Check your personal information, account statuses, and balances for mistakes.

You can argue with each bureau about mistakes online or by mail. Also, include proof, such as receipts for payments, to make your case stronger. Changes usually happen within 30 to 60 days.

2. Pay down your credit card bills

Next, having a lot of credit card debt hurts your credit usage ratio, which makes up 30% of your score. For example, try to maintain this ratio below 30%. Keep your balances below $1,500 if your limit is $5,000. So, getting rid of debt quickly raises your score.

The 30% Myth is the most common myth about credit these days. Spend what comes naturally and always pay your full statement balance every month. You don’t have to worry about the percentage of use or set a limit of 30% or any other number.

3. Make sure bills are paid on time

35% of your credit score is based on your payment history. Because of this, late payments hurt it and stay on your record for years. Set up autopay or reminders for rent, utilities, and loans to avoid this.

If you’ve missed payments, make them up right away. Also, making payments on time every month will raise your score in a few months.

4. Talk to your creditors

Also, getting in touch with creditors to pay off old debts will help. Ask for payment plans or ask for late payment notes to be taken off your account. If you pay in whole or agree to a plan, creditors will usually agree.

Get written agreements. Nonprofit credit counseling services might also help with discussions.

5. Sign up as an Authorized User

Another way is to ask a family member or acquaintance with good credit to let you use their credit card as an authorized user. So, if the creditor reports it, their good payment history will raise your score.

Make sure the cardholder keeps their balances low and pays on time. Also, make sure that the creditor records activity of authorized users.

If it’s damaging your credit score, you can remove yourself or someone else from the list of authorized users.

6. Don’t apply for too many new credit cards

Hard queries from credit applications lower your score a little bit. Also, more than one inquiry makes the damage worse. So, don’t apply for additional cards or loans while you’re working on your score.

Use soft inquiries with prequalification tools to look into credit choices without hurting your score.

7. Get a credit card that is secured

If you can’t get a regular credit card, you might want to look into a secured credit card. You set a cash limit, and when you use it responsibly, credit bureaus report it to them, which helps your score over time.

Buy small things and pay off the rest of the bill every month. This method shows good credit behavior.

8. Keep an eye on your score

Finally, keep an eye on your credit score to see how far you’ve come and stay inspired. A lot of institutions let you keep track of your score for free. Apps like Credit Karma and Experian also give you regular updates.

Every month, check your score. In fact, celebrating modest wins, like 10 to 20 points, will keep you going.

Last Thoughts

In short, you may quick raise your credit score by being focused and developing good habits. You should start seeing results in 30 to 90 days if you repair mistakes, pay off debt, and pay on time. In the end, a higher score opens up better financial options.

[…] Credit cards make people spend too much. In case you are interested in raising your credit score, check out this Quick Ways to Raise Your Credit Score […]

[…] Information about your credit history […]